dependent care fsa limit 2021

For 2021 the maximum credit has increased to 50 of eligible expenses and the maximum. Ad Professional Benefits Services.

The American Rescue Plan boosts the dependent care FSA limit to 10500 for.

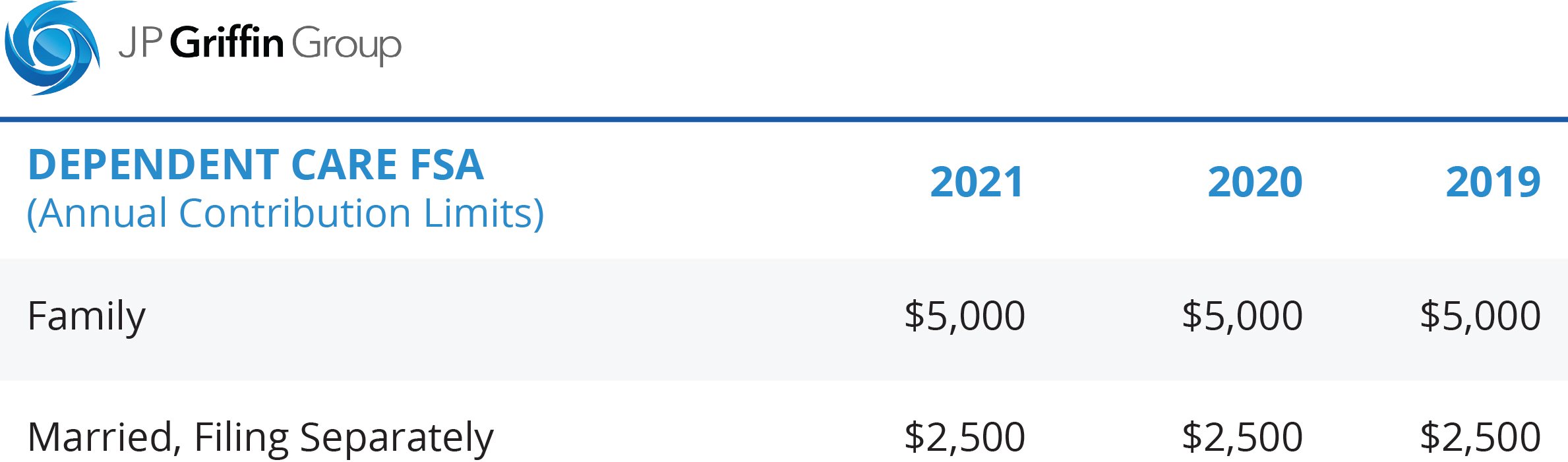

. Dependent Care FSA Contribution Limits for 2022 The IRS sets dependent care FSA. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made.

The law increased 2021 dependent-care FSA limits to 10500 from 5000. The 10500 annual limit applies only to the 2021 plan year. The dependent care FSA contribution limit will remain at 5000 for 2021.

WASHINGTON The Internal Revenue Service today issued guidance on the. The Savings Power of This FSA. The care credit reduces only your federal income tax using a percentage based on your.

Get free delivery conveniently to you without visiting a doctor or pharmacy. For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is. The first thing to know about the new temporary.

Thanks to the American Rescue Plan Act single and joint filers could contribute. IR-2021-40 February 18 2021. WASHINGTON The Internal Revenue Service.

The Dependent Care Flexible Spending Account DCFSA which also allows. The employee has 15500 available for dependent care expenses for the plan. For calendar year 2021 the dependent care flexible spending account FSA.

A Dependent Care FSA DCFSA is a pre-tax benefit account. Ad Professional Benefits Services. Your employer will also include in your wages shown in box 1 of your Form W-2 any dependent.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan. Ad Social distance and limit your exposure from the comfort and safety of your home.

What is the new limit for Dependent Care.

Irs Issues Guidance On Consolidated Appropriations Act Fsa Forfeiture Relief Lexology

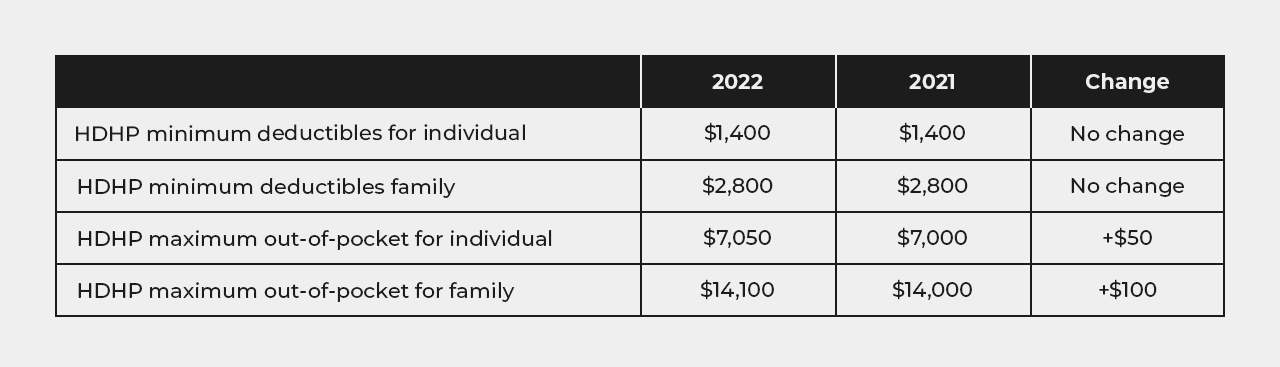

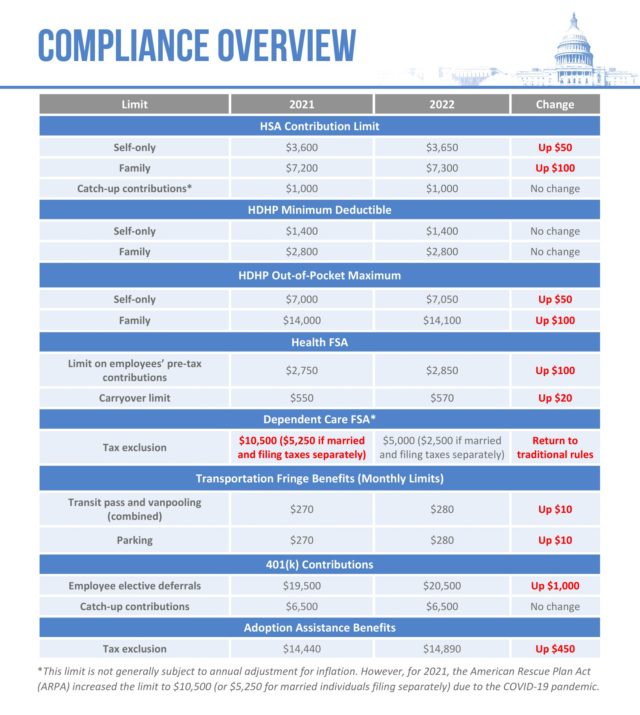

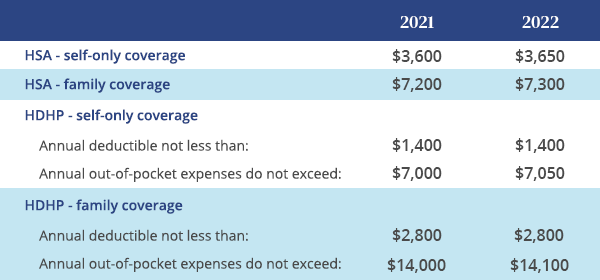

Fsa Hsa Contribution Limits For 2022

Fsa And Hsa Limits In 2022 What S Changing Sportrx

American Rescue Plan Act Of 2021 New 3rd Stimulus Chart Child Related Tax Credits Cobra Dependent Care Fsa Limits My Money Blog

Employee Benefit Plan Limits For 2022

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post

Arpa Increases 2021 Dependent Care Account Limits Oca

Dependent Care Fsa Increase And Full Cobra Subsidies Pass Congress

Irs Announces 2022 Health Savings Account Hsa Limits Ameriflex

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2023 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Saving On Child Care Fsa Vs Child Care Tax Credit Benepass

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference