south dakota property tax rate

An estate tax is the tax that an executor must pay when a property transfers ownership after the death of the current owner. Sales tax is low in South Dakota.

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Real Estate Infographic Map

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

. The state also does not tax income from pensions or withdrawals from retirement accounts like 401k plans. Only the Federal Income Tax applies. The average yearly property tax paid by Haakon County residents amounts to about 141 of their yearly income.

Property tax is the main source of revenue for local governments in South Dakota. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. South Dakotas average effective property tax.

However revenue lost to South Dakota by not having a personal income tax may be made up through other state-level taxes such as the South Dakota. General Property Tax Rules. South Dakota property taxes are based on your homes assessed value as determined by the County Director of Equalization.

A federal estate tax. The statewide rate is 450 and. 2 days agoThe probability of starting up on one side of the border versus the other due to tax rates is 75 higher in South Dakota than Iowa but it may not be for the reasons people think University Professor of Economics Peter Orazem who led the study said in an ISU news release.

Title 10 Codified Laws on Taxation. The states laws must be adhered to in the citys handling of taxation. The median property tax in Tripp County South Dakota is 900 per year for a home worth the median value of 69400.

South Dakota does not have an inheritance tax. This data is based on a 5-year study of median property tax rates on owner-occupied homes in South Dakota conducted from 2006 through 2010. This estimator is based on median property tax values in all of South Dakotas counties which can vary widely.

How do property taxes work in South Dakota. Tripp County collects on average 13 of a propertys assessed fair market value as property tax. Taxation of properties must.

Rules Concerning the Certification of Assessing Officers. Then the property is equalized to 85 for property tax purposes. The State does not collect or.

In other words one mill is equal to 1 of taxes for every 1000 in home value. As Percentage Of Income. Ad valorem means according to value which is done by imposing a tax rate levy to the value of each taxpayers property.

The table below displays the state tax rates average local tax rates and average combined tax rates for South Dakota and its neighboring states. Property tax bills are sent out to property owners in the county based on their individual home value assessments and the current tax rate. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities and counties.

An owner-occupied residence which is a property that the owner lives in is eligible for a lower tax rate than other types of property. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. State statutes require that properties be assessed at their full and true value which is the.

This surpasses both the national average of 107 and the average in North Dakota which is 099. All property is to be assessed at full and true value. The median property tax in Haakon County South Dakota is 724 per year for a home worth the median value of 74800.

The average yearly property tax paid by Tripp County residents amounts to about 191 of their yearly income. A home with a full and true value of 230000 has a taxable value 230000. Property Tax Codified Laws.

For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. South Dakota Estate Tax. The median property tax on a 12620000 house is 161536 in South Dakota.

The average local tax was about 189 percent meaning that the average combined sales tax was about 639 percent. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities and counties. Namely property taxes seem to matter more than other types of taxes and.

To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. In fact South Dakota has no income tax so even money you earn from a post-retirement job wont be taxed by the state. Tax amount varies by county.

The average yearly property tax paid by Bennett County residents amounts to about 166 of their yearly income. Across the state the average effective property tax rate is 122. Information for South Dakota County Treasurers to explain property tax relief programs tax deeds and special assessments.

South Dakota Property Tax Rates. South Dakotas state sales tax was 450 percent in 2017. Appropriate communication of any rate hike is also a requisite.

South Dakota is ranked number twenty seven out of the. Find information tax applications licensing instructions and municipal tax rates for the Sturgis Motorcycle Rally. South Dakota is one of seven states that do not collect a personal income tax.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. The median property tax on a 12620000 house is 132510 in the United States. The voters of South Dakota repealed the.

128 of home value. Bennett County collects on average 133 of a propertys assessed fair market value as property tax. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

Haakon County collects on average 097 of a propertys assessed fair market value as property tax. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. For a more specific estimate find the calculator for your.

On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. The average property tax rate.

South Dakota has no state income tax. South Dakota Property Tax Rates. Across South Dakota the average effective property tax rate is 122.

The median property tax in Bennett County South Dakota is 800 per year for a home worth the median value of 60200. State Summary Tax Assessors. You can look up your recent appraisal by filling out the form below.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

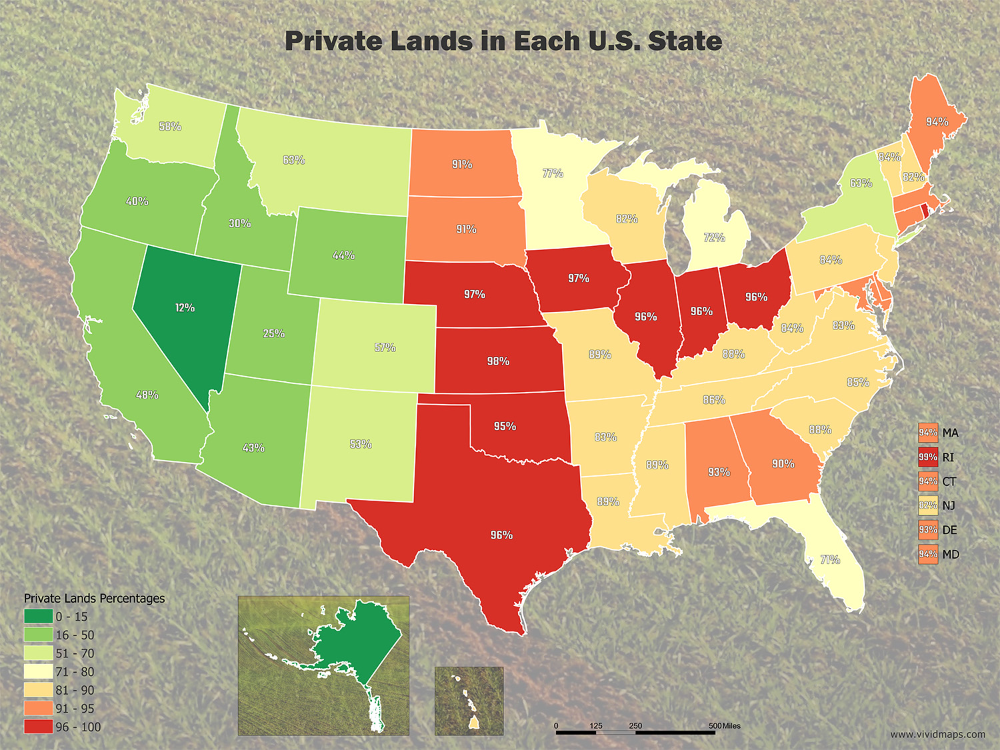

Value Of Private Land In The U S Mapped Vivid Maps Us Map Grand Canyon National Park Private

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Relative Value Of 100 Map Usa Map Cost Of Living

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Tips

States With The Lowest Overall Tax Burden Income Property Sales Business Man Risk Management Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

The Best States For An Early Retirement Early Retirement Life Insurance For Seniors Life Insurance Facts

How Well Funded Are Pension Plans In Your State Tax Foundation Pension Plan Pensions How To Plan

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

The United States Of Sales Tax In One Map Map States Federal Taxes

Mapsontheweb Infographic Map Map Sales Tax

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Retirement Retirement Locations